Rumored Buzz on Frost Pllc

Table of ContentsAll About Frost PllcFrost Pllc Can Be Fun For EveryoneFrost Pllc Things To Know Before You BuyGetting My Frost Pllc To WorkThe Of Frost Pllc

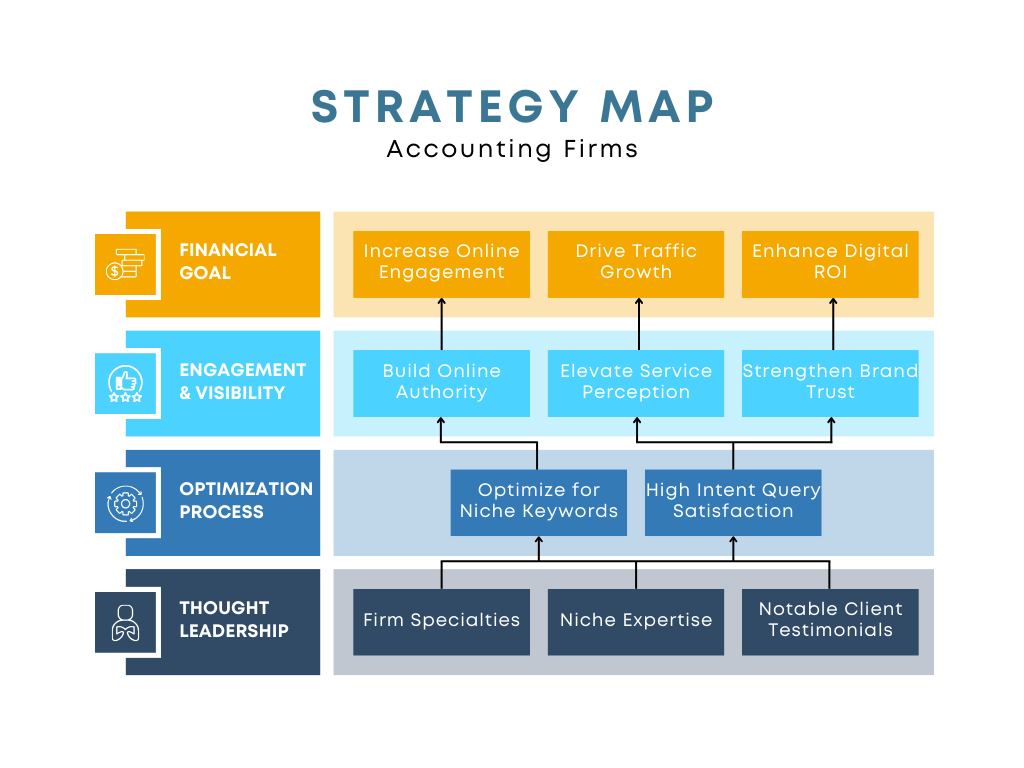

Through a great advertising and marketing and branding method, you can: Develop recognition about your accounting firm. Get the word out regarding your values, objective, and objectives. Establish a distinctive and well-known brand identification. Connect with possible consumers. Increase your market track record. Preserve and enhance connections with existing customers. It can be appealing to market on the go, with the periodic press launch or social media message as the opportunity emerges.Through strategy, you can grow your service and reputation a lot faster than would or else be the situation, with far less risk than would certainly or else hold true. The expense of starting an accounting firm relies on highly variable aspects, consisting of where you remain in the world, prevailing marketing problems, and the services you intend to provide.

Reliable branding and advertising are essential to drawing in clients (Frost PLLC). Costs can range from simple pay-per-click (PAY PER CLICK) advertising to more complicated branding techniques involving customized logos, web sites, and promotional products. Considering all these elements, the price of starting an accountancy firm could range from as little as $2,000 to over $200,000, relying on the scale and intricacy of your operation

Frost Pllc - Truths

Start with basic bookkeeping, tax prep work, or payroll services. The bookkeeping field constantly progresses, and staying up-to-date with the latest developments is crucial.

Word of mouth is the most typical way for book-keeping companies to acquire new clients, as depend on and credibility play such a vital part in book-keeping. There are ways to make sure that word gets out about you and your firm. As an example: in your neighborhood via specialist talking engagements, using sponsorships, assumed leadership campaigns, and generally obtaining your face available (Frost PLLC).

Friends, household, and clients are all wonderful locations to start when collecting brand-new customers. Most bookkeeping companies look for a mix of technological skills, experience, and soft skills.

Previous experience in audit, particularly in a company setup, is highly valued. Companies look for candidates who have a tried and tested track record of taking care of this content economic declarations, tax obligation returns, audits, and various other bookkeeping tasks.

Getting My Frost Pllc To Work

The accounting landscape is frequently advancing, with adjustments in laws and innovation. Companies prefer candidates who are versatile and eager to discover brand-new techniques and technologies. Past technological abilities, companies look for individuals that align with the company's culture and worths. This includes team effort, honesty, and a client-focused technique. For a much more extensive evaluation, undergo our guide on Just how to Employ an Accounting Professional for Your Business: A Step-by-Step Guide, written by CFO Andrew Lokenauth.

Nonetheless, it's necessary to approach it with the very same level of professionalism and reliability and commitment as any type of other company venture. There's a whole lot to consider when you begin an accountancy firm. However by keeping in mind of the suggestions in this post, you can get your brand-new bookkeeping company off to a flying beginning.

As view it now soon as you cover these bases, you'll prepare to begin constructing a name on your own in the accounting world.

Examine with other professional company and companies similar to your own for recommendations on CPAs and/or audit companies. Not all auditors have nonprofit experience, so you should check referrals and request for a duplicate of their Peer Testimonial (most states need auditors to be audited themselves by a 3rd party, which is called a "peer evaluation").

Frost Pllc Fundamentals Explained

Do not fail to remember to inspect with your board participants as part of that investigation. Sometimes complimentary appointments can be an opportunity to speak with prospective CPAs or audit firms. Don't hesitate to request for references and/or resumes of individual CPAs within bigger companies. If you are getting a federal solitary audit know the requirements of 2 CFR Part 200.509 Auditor Choice Seek a CPA or bookkeeping firm that recognizes accounting for charitable nonprofits and has revealed rate of interest in your objective.

This is where the not-for-profit can help manage a few of the costs of the audit! Study companies that stand for the audit career in your state, such as your State Board of Book-keeping, to aid you determine just how to assess the CPA/audit company, based upon standards that CPAs are anticipated to comply with in your state.

As an example, the American Institute of Qualified Accountants requires its CPA members to follow its Code of Expert Conduct.) Make use of a "ask for propositions" procedure. Request a proposition letter from certified CPA firms. Frost PLLC. When asking for a proposal for audit solutions, the purposes and range of the audit need to be clear

:max_bytes(150000):strip_icc()/accountant.asp-FINAL-1-1-e83d0f7de3b848ada757ac5b9af16b72.png)

Frost Pllc - Questions

Our January, 2023 short article recommends some approaches to dealing with the accounting professional staffing and expense issues. Unavoidably, personnel are entailed in the audit field job and in preparing the records that are examined by the auditors. There is always the capacity for a problem because team are executing the interior controls and since they are frequently the individuals with the most possibility to mask monetary irregularities.